Introduction to Insurtech Innovations

Insurtech innovations are transforming the insurance industry, bringing new efficiencies and opportunities for both insurers and policyholders. These technological advancements, which merge insurance with technology, are reshaping traditional insurance practices and driving the sector into a new era. By leveraging big data, artificial intelligence (AI), and blockchain technology, insurtech is not only enhancing customer experiences but also improving risk management and operational efficiency. The integration of these technologies is crucial in understanding how the insurance landscape is evolving.

The Rise of Big Data in Insurtech

Big data is a key component in the surge of insurtech innovations. It allows insurers to gather and analyze vast amounts of information to make more informed decisions. With detailed data on customer behavior, risk profiles, and market trends, insurance companies can tailor their products and services more precisely. This personalized approach helps in predicting claims more accurately and setting premiums that reflect individual risk levels. The ability to process and interpret big data effectively is transforming how insurers operate and interact with their clients.

Artificial Intelligence Enhancing Claims Processing

Artificial intelligence (AI) is another cornerstone of insurtech innovations. AI-powered systems are streamlining claims processing by automating routine tasks and analyzing claims data with unprecedented speed and accuracy. Machine learning algorithms can detect fraudulent claims and predict future risks based on historical data. This not only reduces processing time but also minimizes human error, leading to more efficient and reliable claims management. As AI continues to evolve, its role in the insurance industry is becoming increasingly significant.

Blockchain Technology for Enhanced Security

Blockchain technology is revolutionizing the way data is secured and shared within the insurance sector. By providing a decentralized and immutable ledger, blockchain enhances transparency and reduces the risk of fraud. Smart contracts, a feature of blockchain, automate policy enforcement and claims settlements, ensuring that transactions are executed swiftly and accurately. This technology is also improving data privacy and security, which is crucial in an industry where sensitive information is frequently handled.

The Future of Insurtech Innovations

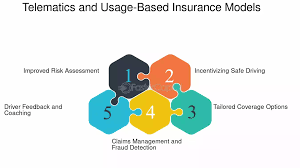

Looking ahead, insurtech innovations are set to further transform the insurance landscape. Emerging technologies such as the Internet of Things (IoT) and advanced analytics will continue to drive changes in how insurance products are developed and delivered. IoT devices, for instance, provide real-time data that can be used to offer usage-based insurance policies and improve risk assessment. As these technologies advance, they will open new avenues for insurers to enhance their services and meet evolving customer expectations.

The Rise of Big Data in Insurtech

Big data is a key component in the surge of insurtech innovations. It allows insurers to gather and analyze vast amounts of information to make more informed decisions. With detailed data on customer behavior, risk profiles, and market trends, insurance companies can tailor their products and services more precisely. This personalized approach helps in predicting claims more accurately and setting premiums that reflect individual risk levels. Moreover, big data enables insurers to identify patterns and trends that were previously invisible, leading to better risk assessment and fraud detection. The ability to process and interpret big data effectively is transforming how insurers operate and interact with their clients, creating opportunities for more dynamic and responsive insurance solutions.

Artificial Intelligence Enhancing Claims Processing

Artificial intelligence (AI) is another cornerstone of insurtech innovations. AI-powered systems are streamlining claims processing by automating routine tasks and analyzing claims data with unprecedented speed and accuracy. Machine learning algorithms can detect fraudulent claims and predict future risks based on historical data. This not only reduces processing time but also minimizes human error, leading to more efficient and reliable claims management. Furthermore, AI chatbots and virtual assistants are improving customer service by providing instant support and answering queries, enhancing the overall user experience. As AI continues to evolve, its role in the insurance industry is becoming increasingly significant, offering potential for more sophisticated and personalized insurance solutions.

Blockchain Technology for Enhanced Security

Blockchain technology is revolutionizing the way data is secured and shared within the insurance sector. By providing a decentralized and immutable ledger, blockchain enhances transparency and reduces the risk of fraud. Smart contracts, a feature of blockchain, automate policy enforcement and claims settlements, ensuring that transactions are executed swiftly and accurately. This technology is also improving data privacy and security, which is crucial in an industry where sensitive information is frequently handled. Additionally, blockchain facilitates seamless data sharing between insurers, reinsurers, and other stakeholders, streamlining operations and reducing administrative overhead. As blockchain technology matures, it holds the promise of further enhancing trust and efficiency within the insurance industry.

The Future of Insurtech Innovations

Looking ahead, insurtech innovations are set to further transform the insurance landscape.

Conclusion

Insurtech innovations are at the forefront of transforming the insurance industry, bringing about significant improvements in efficiency, security, and customer experience. By embracing big data, AI, and blockchain technology, insurers are better equipped to manage risks and deliver more personalized services. The future of insurtech promises even greater advancements, offering exciting possibilities for both insurers and policyholders. As these technologies continue to evolve, they will shape the future of insurance, making it more agile and responsive to the needs of a modern world.

To read complete article Click Here