Introduction to Parametric Insurance

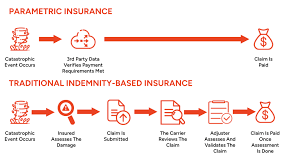

Parametric insurance is a revolutionary approach in the insurance industry that has been gaining traction for its efficiency and straightforwardness. Unlike traditional insurance, which relies on complex claims processes and loss assessments, parametric insurance provides coverage based on predefined parameters or triggers. These triggers are often related to measurable events, such as natural disasters, where payout is automated once specific conditions are met. This method simplifies the insurance process, offering a quick and transparent way to handle claims and reduce the financial strain on individuals and businesses affected by unforeseen events.

How Parametric Insurance Works

Parametric insurance operates on a clear and defined system. Instead of evaluating the extent of damage or loss after an event, insurers use predetermined parameters such as wind speed, rainfall amount, or earthquake magnitude to determine payouts. For instance, if a hurricane exceeds a certain wind speed threshold, a payout is automatically triggered for policyholders. This eliminates lengthy claim procedures and ensures that funds are disbursed swiftly. The use of technology and data analysis plays a crucial role in this process, enabling accurate and timely responses to natural disasters and other covered events.

The Growing Popularity of Parametric Insurance

The popularity of parametric insurance is rising due to its several advantages over traditional insurance models. For businesses and individuals in high-risk areas, such as regions prone to hurricanes or earthquakes, parametric insurance offers a reliable safety net. The immediate payout feature is particularly appealing as it helps in managing cash flow and recovery efforts without the usual delays. Additionally, the transparency and simplicity of the parametric model appeal to a broad audience, including those who may have been previously underserved by conventional insurance products.

Applications in Covering Natural Disasters

One of the most significant applications of parametric insurance is in covering natural disasters. Traditional insurance often struggles with the complexity of assessing damage and calculating claims, especially in widespread or catastrophic events. Parametric insurance, however, can quickly provide financial relief based on predefined parameters, making it an effective tool for disaster response. For example, countries prone to floods or earthquakes can use parametric insurance to ensure that resources are available rapidly for relief and recovery efforts, reducing the impact on affected communities.

Benefits and Challenges

The benefits of parametric insurance are numerous, including faster payouts, reduced administrative costs, and increased transparency. However, there are also challenges to consider. Determining the right parameters and ensuring accurate data can be complex. Additionally, there is a risk that the predetermined triggers might not fully cover the actual financial impact of a disaster. Despite these challenges, the ongoing advancements in technology and data analysis are continually improving the effectiveness and reliability of parametric insurance.

Future Prospects and Developments

Looking ahead, the future of parametric insurance appears promising. With advancements in technology, data collection, and analysis, parametric insurance is expected to become more precise and adaptable. Innovations such as satellite data and real-time monitoring will enhance the ability to set accurate parameters and triggers. As the frequency and intensity of natural disasters increase due to climate change, the role of parametric insurance in providing swift and effective coverage will likely become even more critical.

How Parametric Insurance Works

Parametric insurance operates on a clear and defined system. Instead of evaluating the extent of damage or loss after an event, insurers use predetermined parameters such as wind speed, rainfall amount, or earthquake magnitude to determine payouts. For instance, if a hurricane exceeds a certain wind speed threshold, a payout is automatically triggered for policyholders. This eliminates lengthy claim procedures and ensures that funds are disbursed swiftly. The use of technology and data analysis plays a crucial role in this process, enabling accurate and timely responses to natural disasters and other covered events. Additionally, the reliance on objective measurements helps in reducing disputes and inaccuracies in the claim process.

The Growing Popularity of Parametric Insurance

The popularity of parametric insurance is rising due to its several advantages over traditional insurance models. For businesses and individuals in high-risk areas, such as regions prone to hurricanes or earthquakes, parametric insurance offers a reliable safety net. The immediate payout feature is particularly appealing as it helps in managing cash flow and recovery efforts without the usual delays. Additionally, the transparency and simplicity of the parametric model appeal to a broad audience, including those who may have been previously underserved by conventional insurance products. This growing acceptance reflects a shift towards more innovative and responsive risk management solutions.

Applications in Covering Natural Disasters

One of the most significant applications of parametric insurance is in covering natural disasters. Traditional insurance often struggles with the complexity of assessing damage and calculating claims, especially in widespread or catastrophic events. Parametric insurance, however, can quickly provide financial relief based on predefined parameters, making it an effective tool for disaster response. For example, countries prone to floods or earthquakes can use parametric insurance to ensure that resources are available rapidly for relief and recovery efforts, reducing the impact on affected communities. Moreover, this model can be tailored to specific risks and regional needs, enhancing its effectiveness in diverse environments.

Benefits and Challenges

The benefits of parametric insurance are numerous, including faster payouts, reduced administrative costs, and increased transparency. However, there are also challenges to consider. Determining the right parameters and ensuring accurate data can be complex. Additionally, there is a risk that the predetermined triggers might not fully cover the actual financial impact of a disaster. Despite these challenges, the ongoing advancements in technology and data analysis are continually improving the effectiveness and reliability of parametric insurance. Efforts to refine parameter selection and enhance data accuracy are crucial for addressing these challenges and maximizing the benefits of this innovative insurance model.

Future Prospects and Developments

Looking ahead, the future of parametric insurance appears promising. With advancements in technology, data collection, and analysis, parametric insurance is expected to become more precise

Conclusion

In summary, parametric insurance represents a significant evolution in the insurance landscape, offering a streamlined and efficient alternative to traditional models. Its ability to provide rapid payouts based on predefined parameters makes it an attractive option for managing risks associated with natural disasters. As technology continues to advance, parametric insurance is poised to play an increasingly important role in protecting individuals and businesses from the financial impacts of unforeseen events. By understanding its mechanisms and growing popularity, stakeholders can better prepare for the future of risk management.

To read complete article Click Here