Introduction to Insurance Regulatory Changes

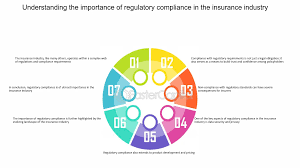

Recent insurance regulatory changes have significantly altered the landscape of the insurance industry. Governments and regulatory bodies worldwide are implementing new rules to address evolving risks and challenges within the sector. These adjustments aim to enhance transparency, protect policyholders, and ensure financial stability for insurers. Understanding these changes is crucial for both insurers and policyholders, as they can affect everything from premium costs to claims processes.

Key Regulatory Changes in Recent Years

Over the past few years, several notable insurance regulatory changes have been introduced. One major shift is the implementation of stricter data protection laws, which require insurers to handle personal information with greater care. Additionally, there have been updates to solvency regulations, mandating that insurers maintain higher levels of reserves to cover potential claims. These changes are designed to strengthen the financial health of insurance companies and improve consumer confidence.

Impact on Insurers

The recent insurance regulatory changes have had a profound impact on insurers. Compliance with new data protection regulations has necessitated significant investments in cybersecurity and data management systems. Insurers are also facing increased operational costs due to the need to enhance their solvency buffers. While these changes can be costly, they are intended to create a more stable and resilient insurance market.

Effects on Policyholders

For policyholders, the impact of insurance regulatory changes is multifaceted. On the positive side, enhanced regulatory oversight aims to provide better protection against unfair practices and ensure that insurers can meet their obligations. However, the costs associated with these regulatory adjustments may lead to higher premiums. Policyholders may also experience changes in the way their personal data is handled, as insurers implement new privacy measures.

The Future of Insurance Regulation

Looking ahead, insurance regulatory changes are likely to continue evolving in response to emerging risks and technological advancements. Regulators are expected to focus on areas such as climate change impacts and the integration of artificial intelligence in insurance processes. Insurers and policyholders alike should stay informed about these developments to navigate the changing regulatory environment effectively.

Key Regulatory Changes in Recent Years

Over the past few years, several notable insurance regulatory changes have been introduced. One major shift is the implementation of stricter data protection laws, which require insurers to handle personal information with greater care. The General Data Protection Regulation (GDPR) in Europe and similar laws in other jurisdictions are setting high standards for data security and privacy. Additionally, updates to solvency regulations, such as the Solvency II Directive in the European Union and the National Association of Insurance Commissioners (NAIC) models in the U.S., mandate that insurers maintain higher levels of reserves to cover potential claims. These changes are designed to strengthen the financial health of insurance companies and improve consumer confidence.

Another significant regulatory change involves the increased focus on environmental, social, and governance (ESG) criteria. Regulators are requiring insurers to integrate ESG factors into their risk management frameworks and disclose how these factors impact their investment and underwriting decisions. This shift reflects growing awareness of the impact of climate change and sustainability issues on the insurance industry.

Impact on Insurers

The recent insurance regulatory changes have had a profound impact on insurers. Compliance with new data protection regulations has necessitated significant investments in cybersecurity and data management systems. Insurers are now required to adopt robust measures to protect sensitive information, which can be costly but is essential for safeguarding against data breaches and maintaining trust.

The increased operational costs associated with meeting higher solvency requirements have also put financial pressure on insurers. Companies must allocate more resources to ensure they can cover potential claims, which may lead to higher insurance premiums for consumers. Insurers are also investing in advanced analytics and technology to improve their risk assessment and management capabilities, aligning with new regulatory expectations.

The emphasis on ESG factors has introduced new challenges and opportunities for insurers. While integrating ESG criteria into business practices can enhance an insurer’s reputation and attract socially conscious investors, it also requires additional resources and expertise. Insurers must develop new strategies for assessing and mitigating ESG-related risks, which can be complex and resource-intensive.

Effects on Policyholders

For policyholders, the impact of insurance regulatory changes is multifaceted. On the positive side, enhanced regulatory oversight aims to provide better protection against unfair practices and ensure that insurers can meet their obligations. Stricter data protection regulations mean that policyholders’ personal information is better safeguarded, reducing the risk of data breaches and identity theft.

However, the costs associated with these regulatory adjustments may lead to higher premiums. Insurers may pass on some of the increased operational and compliance costs to consumers, resulting in more expensive insurance products. Additionally, policyholders may experience changes in how their personal data is handled and how their insurance products are structured.

The increased focus on ESG criteria can also influence policyholders. As insurers adopt more sustainable practices and offer products that consider environmental and social factors, policyholders may have more options for choosing insurance products aligned with their values. This shift could lead to greater consumer satisfaction and loyalty, as policyholders feel more confident that their insurance provider is committed to responsible and ethical practices.

The Future of Insurance Regulation

Looking ahead, insurance regulatory changes are likely to continue evolving in response to emerging risks and technological advancements. Regulators are expected to focus on areas such as climate change impacts and the integration of artificial intelligence in insurance processes. For example, the rise of InsurTech companies and the use of big data analytics are transforming how insurers assess and price risks. Regulatory frameworks will need to adapt to these technological innovations to ensure that they remain effective and relevant.

Insurers and policyholders alike should stay informed about these developments to navigate the changing regulatory environment effectively. Ongoing engagement with industry associations and regulatory bodies can help stakeholders anticipate and prepare for future changes. Insurers may need to invest in continuous compliance efforts and strategic planning to adapt to evolving regulations, while policyholders should be proactive in understanding how regulatory changes impact their insurance products and coverage.

Conclusion

In summary, recent insurance regulatory changes have brought significant shifts to the insurance industry, affecting both insurers and policyholders. While these changes aim to enhance transparency, protect consumers, and ensure financial stability, they also present new challenges and opportunities. By staying informed and adaptable, insurers can navigate these changes effectively, and policyholders can benefit from improved protection and more informed choices. The ongoing evolution of insurance regulation will continue to shape the industry, and its impact will be felt across all facets of the insurance landscape.

To read complete article Click Here