Introduction to Digital Transformation in Insurance

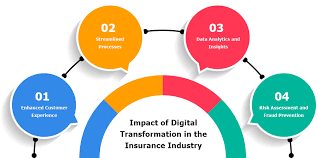

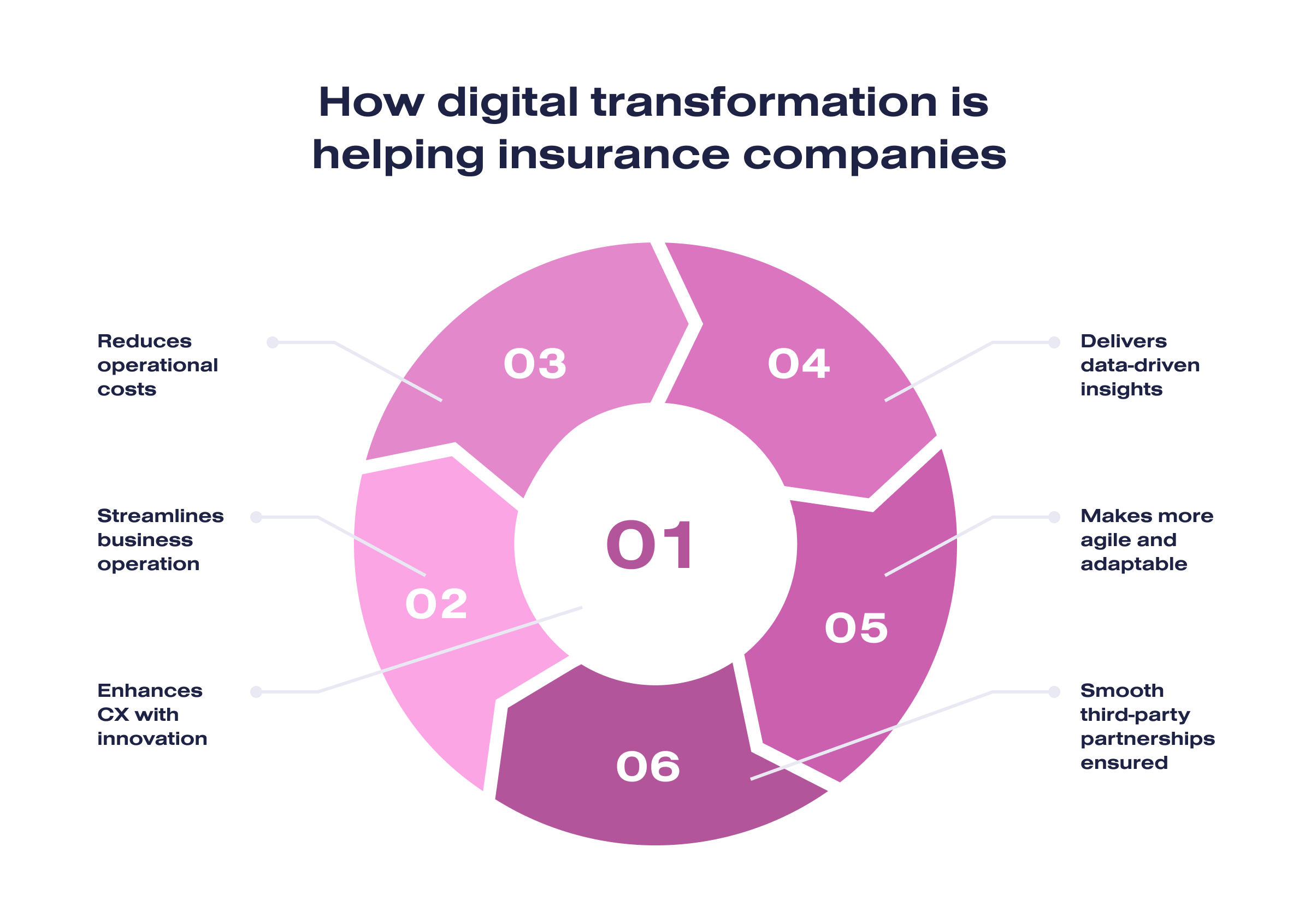

The digital transformation in insurance is revolutionizing how companies operate, interact with customers, and manage risk. This ongoing shift involves a significant move towards online platforms and the integration of big data analytics. Insurance companies are leveraging these advancements to enhance operational efficiency, improve customer experiences, and develop innovative products. As the industry adapts to these changes, the role of technology in shaping the future of insurance becomes increasingly pivotal.

The Shift to Online Platforms

One of the most notable aspects of digital transformation in insurance is the transition to online platforms. Traditional insurance processes, which relied heavily on face-to-face interactions and paper documentation, are being replaced by digital solutions. This shift is driven by the need for greater convenience and accessibility. Online platforms allow customers to purchase policies, manage their accounts, and file claims with just a few clicks. This change not only streamlines operations for insurance companies but also offers a more user-friendly experience for clients.

Leveraging Big Data Analytics

Big data analytics is another crucial element of the digital transformation in insurance. By analyzing vast amounts of data, insurance companies can gain valuable insights into customer behavior, risk factors, and market trends. This data-driven approach enables insurers to create more personalized products and pricing models. For instance, by examining historical data, companies can better predict risks and adjust premiums accordingly. Additionally, big data analytics helps insurers identify emerging trends and respond proactively to changes in the market.

Improving Customer Experience

The integration of digital tools and big data analytics has a profound impact on customer experience. With online platforms, customers enjoy greater flexibility and control over their insurance needs. They can access information and services anytime, anywhere, which enhances overall satisfaction. Furthermore, big data analytics allows insurers to tailor their offerings to individual preferences and needs, leading to more relevant and targeted solutions. This personalized approach not only improves customer engagement but also fosters loyalty and trust.

Challenges and Considerations

Despite the benefits, the digital transformation in insurance also presents several challenges. Companies must navigate issues related to data security, privacy, and regulatory compliance. Ensuring that customer data is protected from breaches and misuse is a top priority. Additionally, insurers must adapt to evolving regulations and maintain transparency in their data practices. Balancing innovation with these considerations is essential for successfully managing the digital shift.

Future Outlook

Looking ahead, the digital transformation in insurance is expected to continue evolving. Advances in technology, such as artificial intelligence and machine learning, will further enhance the capabilities of online platforms and big data analytics. Insurers will likely explore new ways to integrate these technologies to drive efficiency and innovation. As the industry progresses, staying ahead of technological trends and maintaining a focus on customer-centric solutions will be key to thriving in the digital era.

The Shift to Online Platforms

One of the most notable aspects of digital transformation in insurance is the transition to online platforms. Traditional insurance processes, which relied heavily on face-to-face interactions and paper documentation, are being replaced by digital solutions. This shift is driven by the need for greater convenience and accessibility. Online platforms allow customers to purchase policies, manage their accounts, and file claims with just a few clicks. This change not only streamlines operations for insurance companies but also offers a more user-friendly experience for clients.

The adoption of online platforms has also opened up new avenues for customer engagement. Through mobile apps and web portals, insurers can provide real-time updates, personalized notifications, and easy access to policy details. This immediacy and transparency build trust and satisfaction among customers. Additionally, online platforms facilitate better data collection, enabling insurers to refine their services and address customer needs more effectively.

Leveraging Big Data Analytics

Big data analytics is another crucial element of the digital transformation in insurance. By analyzing vast amounts of data, insurance companies can gain valuable insights into customer behavior, risk factors, and market trends. This data-driven approach enables insurers to create more personalized products and pricing models. For instance, by examining historical data, companies can better predict risks and adjust premiums accordingly. Additionally, big data analytics helps insurers identify emerging trends and respond proactively to changes in the market.

One practical application of big data in insurance is in the area of fraud detection. Advanced analytics can detect unusual patterns and flag potential fraudulent activities more accurately than traditional methods. This proactive approach not only helps in mitigating losses but also enhances the overall integrity of the insurance process. Furthermore, big data enables insurers to optimize claims processing by predicting claim volumes and streamlining workflows, leading to faster resolutions and improved customer satisfaction.

Improving Customer Experience

The integration of digital tools and big data analytics has a profound impact on customer experience. With online platforms, customers enjoy greater flexibility and control over their insurance needs. They can access information and services anytime, anywhere, which enhances overall satisfaction. Furthermore, big data analytics allows insurers to tailor their offerings to individual preferences and needs, leading to more relevant and targeted solutions. This personalized approach not only improves customer engagement but also fosters loyalty and trust.

Moreover, digital transformation has facilitated the rise of Usage-Based Insurance (UBI), which aligns insurance costs with actual usage patterns. For example, telematics devices installed in vehicles collect data on driving habits, allowing insurers to offer personalized premiums based on real-time behavior. This shift towards more tailored and dynamic insurance models reflects the broader trend of digitalization and its impact on creating value for both insurers and customers.

Challenges and Considerations

Despite the benefits, the digital transformation in insurance also presents several challenges. Companies must navigate issues related to data security, privacy, and regulatory compliance. Ensuring that customer data is protected from breaches and misuse is a top priority. Additionally, insurers must adapt to evolving regulations and maintain transparency in their data practices. Balancing innovation with these considerations is essential for successfully managing the digital shift.

Another challenge is the need for continuous investment in technology and talent. As digital transformation accelerates, insurance companies must keep pace with rapidly changing technologies and evolving customer expectations. This requires not only upgrading systems and processes but also fostering a culture of innovation and agility within the organization. Training employees and investing in digital skills are critical for maximizing the benefits of digital transformation.

Future Outlook

Looking ahead, the digital transformation in insurance is expected to continue evolving. Advances in technology, such as artificial intelligence and machine learning, will further enhance the capabilities of online platforms and big data analytics. Insurers will likely explore new ways to integrate these technologies to drive efficiency and innovation. For instance, AI-powered chatbots and virtual assistants could become more prevalent, providing customers with instant support and information.

As the industry progresses, staying ahead of technological trends and maintaining a focus on customer-centric solutions will be key to thriving in the digital era. Insurers will need to remain agile and responsive to changes in technology and customer behavior to ensure long-term success. Embracing digital transformation not only offers a competitive edge but also positions insurance companies to better meet the evolving needs of their customers.

To read complete article Click Here