The impact of climate change on property insurance premiums and coverage has become increasingly evident as extreme weather events and rising sea levels disrupt traditional risk models. With more frequent and severe natural disasters, insurance companies are facing unprecedented challenges in assessing and managing risk. This shifting landscape has significant implications for both insurers and homeowners, making it crucial to understand how climate change is altering the insurance market. The growing prevalence of climate-related events is reshaping how property insurance is priced and structured, leading to new dynamics in coverage and premiums.

Rising Premiums and Shifting Coverage

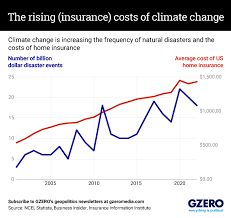

One of the most immediate effects of climate change on property insurance is the noticeable increase in premiums. As the frequency and intensity of weather-related disasters escalate, insurers are encountering higher costs associated with claims. To compensate for these increased expenses, insurance companies are adjusting premiums, often resulting in significantly higher costs for policyholders. Areas previously considered low-risk are now experiencing surges in insurance premiums, reflecting the growing uncertainty and potential for damage. Furthermore, insurers are revising their coverage policies to manage their exposure, which can lead to reduced coverage options or higher deductibles in high-risk regions.

Adapting Risk Models and Pricing Strategies

In response to the challenges posed by climate change, insurers are investing in advanced risk modeling and pricing strategies. Traditional actuarial models, which historically relied on historical data and trends, are being updated to incorporate climate change projections. This shift allows insurers to better predict future risks and adjust premiums accordingly. For example, new models might factor in increased rainfall patterns, rising sea levels, or more intense storms. While these advancements help create more accurate risk assessments, they also require significant resources and sophisticated data analytics. As a result, the adaptation of risk models can be costly, influencing both insurance providers and policyholders.

Insurance Market Trends and Regional Disparities

The impact of climate change on property insurance is not uniform across all regions. The severity of changes varies depending on local climate risks and geographic factors. For instance, coastal areas prone to hurricanes, flooding, and rising sea levels are experiencing more drastic shifts in insurance availability and costs. In these regions, insurers may withdraw from the market or offer limited coverage options due to the high risk of damage. Conversely, inland or less climate-affected areas may see more stable insurance markets. This disparity underscores the importance of localized risk assessments and tailored insurance solutions that address specific regional challenges.

The Role of Government and Policy Changes

Government policies and regulations play a critical role in shaping the response of the property insurance industry to climate change. Initiatives aimed at mitigating climate risks, such as stricter building codes and investment in infrastructure improvements, can help reduce the financial burden on insurers and policyholders. Additionally, some governments are exploring public-private partnerships to provide coverage for high-risk areas, thus enhancing market stability. Policy changes and incentives that promote climate resilience and risk reduction can also influence insurance practices and coverage options. By aligning insurance policies with broader climate strategies, governments can contribute to a more resilient and adaptive insurance market.

Future Outlook and Emerging Solutions

Looking ahead, the property insurance industry is expected to continue evolving in response to climate change. Technological innovations, such as predictive analytics and advanced climate modeling, are anticipated to play a significant role in shaping future insurance practices. These tools can provide more precise risk assessments and support the development of innovative coverage options. Additionally, there is growing interest in promoting climate resilience through insurance incentives that encourage homeowners to invest in mitigation measures, such as flood defenses or wildfire-resistant materials. As the effects of climate change become more pronounced, the insurance industry will need to remain agile and proactive in addressing emerging risks and opportunities.

Conclusion: Navigating the New Normal

The impact of climate change on property insurance premiums and coverage highlights the need for both insurers and policyholders to adapt to a rapidly changing risk environment. As extreme weather events become more common and severe, understanding the implications for insurance coverage is crucial for managing risks effectively. By staying informed about evolving risk models, regional trends, and policy changes, homeowners and insurers can better navigate the complexities of a climate-affected insurance market. The ability to adapt and innovate in response to climate challenges will be key to ensuring the sustainability and effectiveness of property insurance in the future.