The COVID-19 pandemic has significantly reshaped the landscape of health insurance, leading to notable shifts in coverage needs and policyholder behavior. As the world begins to recover, the focus on post-pandemic health insurance trends has never been more critical. This article explores how the pandemic has influenced these trends, highlighting key changes in coverage requirements and the evolving expectations of policyholders.

Changing Coverage Needs

One of the most prominent post-pandemic health insurance trends is the shift in coverage needs. The pandemic underscored the importance of comprehensive health insurance, leading to increased demand for policies that cover a broader range of services. Many individuals now seek plans that include telemedicine, mental health support, and pandemic-related benefits. As a result, insurers have adjusted their offerings to accommodate these new priorities, reflecting a shift towards more inclusive and flexible coverage options.

Increased Emphasis on Mental Health

Another significant trend is the increased emphasis on mental health coverage. The pandemic has had a profound impact on mental well-being, with many individuals experiencing heightened levels of stress and anxiety. In response, health insurance providers are expanding their mental health benefits, offering more robust coverage for therapy, counseling, and psychiatric services. This shift highlights a growing recognition of the importance of mental health in overall wellness and the need for insurance policies that address these needs comprehensively.

Telemedicine Integration

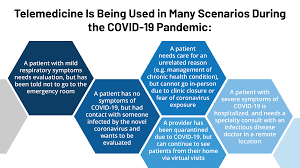

Telemedicine has emerged as a key component of post-pandemic health insurance trends. The necessity of remote healthcare during the pandemic accelerated the adoption of telemedicine services, and this trend continues to thrive. Health insurers are increasingly integrating telemedicine into their policies, offering convenient and accessible care options for policyholders. This integration not only enhances the flexibility of healthcare services but also aligns with the evolving preferences of consumers who value the convenience of virtual consultations.

Behavioral Changes Among Policyholders

The pandemic has also led to notable changes in policyholder behavior. Many individuals have become more proactive about their health, seeking preventive care and regular check-ups to avoid potential health issues. This shift is influencing how people choose their insurance plans, with a growing preference for policies that offer comprehensive preventive services and wellness programs. Insurers are responding to this trend by incorporating more preventive care options and wellness incentives into their plans.

The Future of Health Insurance

Looking ahead, the post-pandemic landscape of health insurance will likely continue to evolve. The trends observed during the pandemic, such as the focus on mental health, telemedicine, and preventive care, are expected to remain relevant. Insurers will need to adapt to these ongoing changes by offering policies that align with the evolving needs and preferences of their customers. The future of health insurance will likely be characterized by greater flexibility, inclusivity, and a continued emphasis on comprehensive care.

Changing Coverage Needs

One of the most prominent post-pandemic health insurance trends is the shift in coverage needs. The pandemic underscored the importance of comprehensive health insurance, leading to increased demand for policies that cover a broader range of services. Many individuals now seek plans that include telemedicine, mental health support, and pandemic-related benefits. As a result, insurers have adjusted their offerings to accommodate these new priorities, reflecting a shift towards more inclusive and flexible coverage options.

For instance, plans now frequently include expanded coverage for COVID-19 testing, vaccinations, and treatments. This adaptation ensures that policyholders are protected against emerging health threats and have access to necessary resources during future crises. Additionally, coverage for long-term effects of COVID-19, such as post-acute sequelae, has become more common, illustrating the ongoing impact of the pandemic on health insurance.

Increased Emphasis on Mental Health

Another significant trend is the increased emphasis on mental health coverage. The pandemic has had a profound impact on mental well-being, with many individuals experiencing heightened levels of stress and anxiety. In response, health insurance providers are expanding their mental health benefits, offering more robust coverage for therapy, counseling, and psychiatric services. This shift highlights a growing recognition of the importance of mental health in overall wellness and the need for insurance policies that address these needs comprehensively.

Mental health coverage now often includes access to a wider network of mental health professionals, online therapy platforms, and crisis intervention services. Insurers are also integrating mental health support into their overall wellness programs, offering resources such as stress management workshops and mental health screenings. This comprehensive approach aims to address both immediate and long-term mental health needs, reflecting a broader understanding of mental wellness.

Telemedicine Integration

Telemedicine has emerged as a key component of post-pandemic health insurance trends. The necessity of remote healthcare during the pandemic accelerated the adoption of telemedicine services, and this trend continues to thrive. Health insurers are increasingly integrating telemedicine into their policies, offering convenient and accessible care options for policyholders. This integration not only enhances the flexibility of healthcare services but also aligns with the evolving preferences of consumers who value the convenience of virtual consultations.

Moreover, telemedicine is helping to bridge gaps in access to care, particularly in rural or underserved areas. By offering virtual consultations, insurers can ensure that policyholders receive timely medical attention without the need for extensive travel. This shift is also accompanied by the development of new technologies and platforms that facilitate seamless virtual interactions between patients and healthcare providers, further enhancing the accessibility and effectiveness of telemedicine services.

Behavioral Changes Among Policyholders

The pandemic has also led to notable changes in policyholder behavior. Many individuals have become more proactive about their health, seeking preventive care and regular check-ups to avoid potential health issues. This shift is influencing how people choose their insurance plans, with a growing preference for policies that offer comprehensive preventive services and wellness programs. Insurers are responding to this trend by incorporating more preventive care options and wellness incentives into their plans.

This proactive approach extends to lifestyle management as well, with policyholders increasingly seeking insurance plans that support healthy living through benefits such as fitness programs, nutrition counseling, and chronic disease management. Insurers are recognizing the value of these services in promoting overall health and reducing long-term healthcare costs, leading to a greater emphasis on preventive and wellness-oriented coverage.

The Future of Health Insurance

Looking ahead, the post-pandemic landscape of health insurance will likely continue to evolve. The trends observed during the pandemic, such as the focus on mental health, telemedicine, and preventive care, are expected to remain relevant. Insurers will need to adapt to these ongoing changes by offering policies that align with the evolving needs and preferences of their customers. The future of health insurance will likely be characterized by greater flexibility, inclusivity, and a continued emphasis on comprehensive care.

As health insurance providers navigate this new era, they will also need to address emerging challenges such as data privacy, technology integration, and regulatory changes. The ability to innovate and respond to these challenges will be crucial in shaping the future of health insurance and ensuring that it meets the needs of a dynamic and evolving population.

To read complete article Click Here