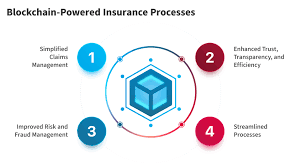

In recent years, blockchain technology has emerged as a transformative force across various industries, including health insurance. The integration of blockchain into health insurance offers a promising solution to enhance data security, reduce fraud, and streamline administrative processes. This article explores the potential benefits of blockchain in health insurance and its implications for the future of the industry.

Focus Keyword: Blockchain in health insurance

Enhancing Data Security with Blockchain

One of the primary advantages of blockchain in health insurance is its ability to enhance data security. Traditional health insurance systems often struggle with data breaches and unauthorized access to sensitive patient information. Blockchain technology offers a decentralized ledger system where data is encrypted and stored across a network of computers. Each transaction is recorded in a block, and once added to the chain, it cannot be altered or deleted. This immutability ensures that patient data is secure and protected from tampering, significantly reducing the risk of data breaches and identity theft.

Reducing Fraud with Blockchain

Fraud is a significant concern in the health insurance industry, with fraudulent claims costing billions annually. Blockchain technology can play a crucial role in reducing fraud by providing a transparent and immutable record of all transactions. Each claim and payment is recorded on the blockchain, creating an audit trail that is visible to all authorized parties. This transparency makes it easier to detect and investigate fraudulent activities, such as false claims or billing errors. Additionally, smart contracts—self-executing contracts with predefined rules—can automate claim processing and ensure that only valid claims are paid out, further reducing the potential for fraud.

Streamlining Administrative Processes

Administrative inefficiencies are a common issue in health insurance, often leading to delays and increased costs. Blockchain technology can streamline these processes by automating and simplifying transactions. For example, blockchain can facilitate the secure exchange of information between insurers, healthcare providers, and patients. This reduces the need for intermediaries and paperwork, speeding up claims processing and reducing administrative overhead. Smart contracts can also automate routine tasks, such as verifying policy coverage or processing payments, allowing insurers to focus on more strategic activities.

Improving Interoperability and Data Sharing

Another significant benefit of blockchain in health insurance is its potential to improve interoperability and data sharing. In the current system, patient information is often fragmented across multiple providers and insurers, leading to inefficiencies and potential errors. Blockchain’s decentralized nature allows for secure and seamless data sharing between different parties. Patients can grant access to their health records to multiple providers and insurers through a single blockchain-based system, ensuring that all parties have up-to-date and accurate information. This improved data sharing can lead to better patient outcomes and more efficient care coordination.

Future Implications and Challenges

While the potential of blockchain in health insurance is promising, there are challenges that need to be addressed before widespread adoption can occur. These include regulatory considerations, the need for standardization, and the integration of blockchain with existing systems. Additionally, the technology’s scalability and its impact on data privacy must be carefully evaluated. As the industry continues to explore blockchain solutions, collaboration between stakeholders, including insurers, technology providers, and regulators, will be essential to overcoming these challenges and realizing the full potential of blockchain in health insurance.

Enhancing Data Security with Blockchain

One of the primary advantages of blockchain in health insurance is its ability to enhance data security. Traditional health insurance systems often struggle with data breaches and unauthorized access to sensitive patient information. Blockchain technology offers a decentralized ledger system where data is encrypted and stored across a network of computers. Each transaction is recorded in a block, and once added to the chain, it cannot be altered or deleted. This immutability ensures that patient data is secure and protected from tampering, significantly reducing the risk of data breaches and identity theft.

Reducing Fraud with Blockchain

Fraud is a significant concern in the health insurance industry, with fraudulent claims costing billions annually. Blockchain technology can play a crucial role in reducing fraud by providing a transparent and immutable record of all transactions. Each claim and payment is recorded on the blockchain, creating an audit trail that is visible to all authorized parties. This transparency makes it easier to detect and investigate fraudulent activities, such as false claims or billing errors. Additionally, smart contracts—self-executing contracts with predefined rules—can automate claim processing and ensure that only valid claims are paid out, further reducing the potential for fraud.

Streamlining Administrative Processes

Administrative inefficiencies are a common issue in health insurance, often leading to delays and increased costs. Blockchain technology can streamline these processes by automating and simplifying transactions. For example, blockchain can facilitate the secure exchange of information between insurers, healthcare providers, and patients. This reduces the need for intermediaries and paperwork, speeding up claims processing and reducing administrative overhead. Smart contracts can also automate routine tasks, such as verifying policy coverage or processing payments, allowing insurers to focus on more strategic activities.

Improving Interoperability and Data Sharing

Another significant benefit of blockchain in health insurance is its potential to improve interoperability and data sharing. In the current system, patient information is often fragmented across multiple providers and insurers, leading to inefficiencies and potential errors. Blockchain’s decentralized nature allows for secure and seamless data sharing between different parties. Patients can grant access to their health records to multiple providers and insurers through a single blockchain-based system, ensuring that all parties have up-to-date and accurate information. This improved data sharing can lead to better patient outcomes and more efficient care coordination.

Future Implications and Challenges

While the potential of blockchain in health insurance is promising, there are challenges that need to be addressed before widespread adoption can occur. These include regulatory considerations, the need for standardization, and the integration of blockchain with existing systems. Additionally, the technology’s scalability and its impact on data privacy must be carefully evaluated. As the industry continues to explore blockchain solutions, collaboration between stakeholders, including insurers, technology providers, and regulators, will be essential to overcoming these challenges and realizing the full potential of blockchain in health insurance.

Blockchain Adoption Trends

The adoption of blockchain in health insurance is still in its early stages, but trends indicate growing interest and investment. Major insurers and health tech companies are exploring pilot programs and partnerships to test blockchain applications. As more successful implementations are demonstrated, the industry is likely to see accelerated adoption and innovation. The gradual integration of blockchain technology can lead to more secure, efficient, and transparent health insurance processes, benefiting all stakeholders involved.

To read complete article Click Here