As the gig economy continues to flourish, traditional health insurance models are being challenged to adapt to the unique needs of freelancers and independent contractors. Health insurance for gig economy workers is evolving rapidly, with new policies and marketplace solutions designed to bridge gaps left by conventional insurance plans. In this article, we will explore how health insurance options are changing for gig economy workers and highlight innovative solutions shaping the future of coverage.

The Rise of Gig Economy and Its Insurance Challenges

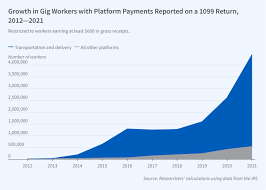

The gig economy has transformed the workforce landscape, with millions of individuals now engaged in freelance and contract work. However, this shift has brought to light significant challenges regarding health insurance coverage. Traditional employer-sponsored health insurance is not applicable for many gig workers, who must navigate a complex web of insurance options to find suitable coverage. This disparity has led to a growing demand for tailored health insurance solutions that address the unique needs of this burgeoning workforce.

New Policies Tailored for Freelancers

In response to the needs of gig economy workers, several new policies have been introduced to enhance access to health insurance. One notable development is the expansion of individual health insurance plans through the Affordable Care Act (ACA) marketplaces. These plans provide more flexibility and options for freelancers who lack employer-sponsored coverage. Additionally, some states have introduced innovative programs aimed at providing subsidized or low-cost health insurance to gig workers, ensuring that they can access affordable care without sacrificing quality.

Marketplace Solutions Revolutionizing Coverage

The evolution of health insurance for gig economy workers is also being driven by advancements in marketplace solutions. Online platforms and insurance technology companies are creating new ways for freelancers to compare and purchase health insurance plans. These digital solutions offer a streamlined approach to finding coverage, allowing gig workers to easily assess their options, compare costs, and select plans that best meet their needs. This shift towards technology-driven solutions is making it easier for freelancers to navigate the complexities of health insurance and find coverage that fits their individual circumstances.

The Role of Professional Associations and Networks

Professional associations and networks are playing a crucial role in advocating for better health insurance options for gig economy workers. These organizations are pushing for policy changes and providing resources to help freelancers understand their insurance options. By offering group health insurance plans and negotiating better rates on behalf of their members, these associations are helping to fill the gaps left by traditional insurance models. Additionally, they are working to raise awareness about the importance of health coverage and the available options for gig workers.

Future Trends and Innovations in Gig Economy Health Insurance

Looking ahead, several trends and innovations are expected to further shape the landscape of health insurance for gig economy workers. The integration of artificial intelligence and data analytics is poised to enhance the personalization of health insurance plans, making it easier for freelancers to find coverage that aligns with their health needs and financial situation. Furthermore, as the gig economy continues to grow, there may be increased efforts to develop new insurance models and policies specifically designed for this segment of the workforce, providing even more tailored and accessible options.

The Rise of Gig Economy and Its Insurance Challenges

The gig economy has transformed the workforce landscape, with millions of individuals now engaged in freelance and contract work. However, this shift has brought to light significant challenges regarding health insurance coverage. Traditional employer-sponsored health insurance is not applicable for many gig workers, who must navigate a complex web of insurance options to find suitable coverage. This disparity has led to a growing demand for tailored health insurance solutions that address the unique needs of this burgeoning workforce. Many gig workers are facing uncertainty about their coverage and the affordability of insurance, which has sparked a push for more accessible and comprehensive solutions.

New Policies Tailored for Freelancers

In response to the needs of gig economy workers, several new policies have been introduced to enhance access to health insurance. One notable development is the expansion of individual health insurance plans through the Affordable Care Act (ACA) marketplaces. These plans provide more flexibility and options for freelancers who lack employer-sponsored coverage. The ACA’s provision for subsidies based on income also helps reduce the financial burden on gig workers. Additionally, some states have introduced innovative programs aimed at providing subsidized or low-cost health insurance to gig workers, ensuring that they can access affordable care without sacrificing quality. These state-level initiatives are crucial in addressing the specific needs of gig workers who may not qualify for traditional programs.

Marketplace Solutions Revolutionizing Coverage

The evolution of health insurance for gig economy workers is also being driven by advancements in marketplace solutions. Online platforms and insurance technology companies are creating new ways for freelancers to compare and purchase health insurance plans. These digital solutions offer a streamlined approach to finding coverage, allowing gig workers to easily assess their options, compare costs, and select plans that best meet their needs. Platforms like HealthCare.gov and private insurance marketplaces are increasingly incorporating user-friendly tools and resources that simplify the decision-making process. This shift towards technology-driven solutions is making it easier for freelancers to navigate the complexities of health insurance and find coverage that fits their individual circumstances. Additionally, some marketplaces are offering tailored advice and support specifically for gig workers, helping them make informed decisions.

The Role of Professional Associations and Networks

Professional associations and networks are playing a crucial role in advocating for better health insurance options for gig economy workers. These organizations are pushing for policy changes and providing resources to help freelancers understand their insurance options. By offering group health insurance plans and negotiating better rates on behalf of their members, these associations are helping to fill the gaps left by traditional insurance models. For instance, the Freelancers Union offers health insurance plans specifically designed for independent workers and provides educational resources to help them navigate their options. Additionally, they are working to raise awareness about the importance of health coverage and the available options for gig workers. The collective efforts of these organizations are instrumental in improving access to affordable health insurance.

Future Trends and Innovations in Gig Economy Health Insurance

Looking ahead, several trends and innovations are expected to further shape the landscape of health insurance for gig economy workers. The integration of artificial intelligence and data analytics is poised to enhance the personalization of health insurance plans, making it easier for freelancers to find coverage that aligns with their health needs and financial situation. AI-driven tools can analyze individual health data and provide tailored recommendations for insurance plans. Furthermore, as the gig economy continues to grow, there may be increased efforts to develop new insurance models and policies specifically designed for this segment of the workforce, providing even more tailored and accessible options. The rise of telemedicine and virtual care is also likely to play a significant role in the future of health insurance for gig workers, offering more flexible and convenient access to healthcare services.

Conclusion

The evolution of health insurance for gig economy workers represents a significant shift in how coverage is approached for this growing workforce. With new policies, marketplace solutions, and the support of professional associations, freelancers and independent contractors are gaining better access to health insurance options. As the industry continues to adapt, gig workers can expect even more innovative solutions and improved coverage options that meet their unique needs.

To read complete article Click Here