In the ever-evolving landscape of material insurance, technology is significantly enhancing risk management practices. The sector, historically reliant on traditional methods, is now embracing innovative solutions to better assess, monitor, and mitigate risks. This transformation is driven by advancements in technology, which are reshaping the way material insurance operates. This article explores how these technological innovations are revolutionizing material insurance and their impact on risk management.

The Role of Technology in Material Insurance

Technology is playing a crucial role in transforming material insurance by offering sophisticated tools for risk assessment and management. The integration of advanced data analytics into the insurance process allows for more precise evaluations of potential risks. Insurers now leverage big data to analyze extensive information sets, which helps in predicting future risks and tailoring insurance policies to meet specific needs. This data-driven approach enhances the accuracy of risk assessments and improves the overall efficiency of material insurance.

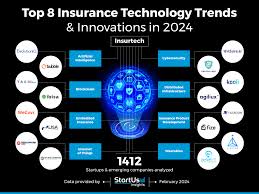

The shift towards technology-driven risk management also involves the use of artificial intelligence (AI) and machine learning. These technologies analyze historical data and recognize patterns that might indicate future risks. By processing large datasets quickly and accurately, AI and machine learning tools provide insights that were previously unattainable with traditional methods. This technological evolution helps insurers understand material risks better and implement strategies to mitigate them effectively.

Advanced Risk Assessment Tools

One of the most significant advancements in material insurance is the development of advanced risk assessment tools. Machine learning algorithms and AI models are increasingly used to evaluate material risks by analyzing historical data and identifying patterns. For example, predictive models can assess the likelihood of material failure based on environmental conditions, usage patterns, and other factors. This capability allows insurers to create more accurate risk profiles and adjust coverage accordingly.

Moreover, these tools enable insurers to simulate various scenarios and predict how different factors might impact material integrity. This simulation capability is particularly valuable in industries where materials are exposed to diverse and unpredictable conditions. By using advanced risk assessment tools, insurers can proactively address potential issues before they lead to significant losses, enhancing their ability to manage and mitigate risks effectively.

Real-Time Monitoring and IoT Integration

The integration of the Internet of Things (IoT) into material insurance represents a groundbreaking development. IoT technology involves the use of sensors and smart devices to monitor material conditions in real-time. For instance, sensors can track temperature, humidity, and other environmental factors that may affect material integrity. This real-time data provides insurers with up-to-date information on the condition of insured materials, enabling them to respond quickly to potential risks.

Real-time monitoring through IoT also facilitates more dynamic risk management. For example, if a sensor detects abnormal temperature fluctuations in a storage facility, the insurer can take immediate action to prevent potential damage. This proactive approach reduces the likelihood of material loss and enhances overall risk management. Additionally, IoT integration allows for more accurate underwriting by providing insurers with detailed data on material conditions.

Enhanced Claims Processing with Blockchain

Blockchain technology is making significant strides in material insurance, particularly in the area of claims processing. Blockchain’s decentralized and immutable nature ensures that all transactions are recorded transparently and securely. This innovation helps in preventing fraud and verifying the authenticity of claims. By using blockchain, insurers can streamline the claims process, making it faster and more reliable for all parties involved.

Blockchain also improves data integrity and reduces administrative costs associated with claims processing. The technology enables real-time updates and automated verification of claims, which enhances efficiency and accuracy. As a result, insurers can provide quicker resolutions to claims and reduce the potential for disputes. This advancement in claims processing is a significant benefit for both insurers and policyholders.

Predictive Analytics for Future Risk Management

Predictive analytics is becoming increasingly important in material insurance, offering insurers tools to anticipate and manage future risks. By analyzing trends and historical data, predictive models can forecast potential risks and help develop strategies to address them proactively. This approach allows insurers to adjust policies and risk management practices based on anticipated developments, improving their ability to safeguard material assets.

For instance, predictive analytics can identify emerging risk factors, such as changes in environmental conditions or new material vulnerabilities. This foresight enables insurers to adapt their coverage and risk management strategies accordingly. The use of predictive analytics helps insurers stay ahead of potential issues and enhances their overall risk management capabilities.

The Future of Material Insurance

The future of material insurance is set to be increasingly influenced by technological advancements. Innovations such as AI, IoT, and blockchain are expected to continue evolving, offering even more sophisticated solutions for risk management. As technology progresses, material insurance will benefit from more accurate risk assessments, improved real-time monitoring, and streamlined processes.

The ongoing integration of these technologies will likely lead to more personalized and effective insurance solutions. Insurers will be able to provide tailored coverage based on precise risk assessments and real-time data. This shift will enhance the ability to manage and mitigate risks, ultimately leading to better protection and management of material assets.

In conclusion, technology is revolutionizing material insurance by enhancing risk management practices. Innovations such as advanced data analytics, machine learning, IoT, and blockchain are transforming how insurers assess and manage risks. As these technologies continue to advance, material insurance will become more efficient, accurate, and responsive, providing better protection for material assets and improving overall risk management.

To read more articles like this click here.

To read more about such topics click here.