Pharmacy Benefit Managers (PBMs) play a crucial role in the landscape of drug pricing, significantly influencing both health insurance premiums and out-of-pocket costs for consumers. As intermediaries between insurers, drug manufacturers, and pharmacies, PBMs are responsible for negotiating drug prices and managing prescription drug benefits. Their actions can have a profound impact on the overall cost of medications and the financial burden on patients. This article delves into the role of PBMs in drug pricing, exploring how their practices affect health insurance premiums and out-of-pocket expenses.

The Role of PBMs in Drug Pricing

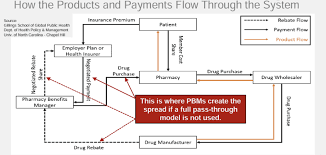

Pharmacy Benefit Managers serve as the gatekeepers for prescription drug benefits. They negotiate directly with drug manufacturers to secure rebates and discounts, which can help lower the cost of medications for insurance companies. These savings are often intended to be passed on to consumers, but the extent to which this occurs can vary. PBMs also manage formularies, which are lists of covered drugs, and establish preferred drug lists that influence which medications are more affordable for patients. By negotiating lower prices and managing formularies, PBMs aim to reduce the overall cost of drugs, but their impact on drug pricing is complex and multifaceted.

How PBMs Affect Health Insurance Premiums

The influence of PBMs on health insurance premiums is significant. By negotiating lower drug prices and rebates, PBMs can help reduce the cost of prescription drugs for insurers. This, in turn, can lead to lower premiums for health insurance plans. However, the relationship between PBMs and premiums is not always straightforward. Some critics argue that the savings negotiated by PBMs do not always translate into lower premiums for consumers. Additionally, the rebates and discounts secured by PBMs may be partially offset by administrative fees and other costs, which can affect the overall cost structure of insurance plans.

Impact on Out-of-Pocket Costs

PBMs also play a critical role in determining out-of-pocket costs for patients. The structure of formularies and the tier placement of drugs can significantly influence what patients pay at the pharmacy counter. Medications on higher tiers of a formulary typically come with higher co-pays or coinsurance, increasing the financial burden on patients. While PBMs strive to manage drug costs and improve affordability, the design of formularies and the extent of patient cost-sharing can lead to varying levels of out-of-pocket expenses. Understanding how PBMs impact out-of-pocket costs is essential for consumers navigating their prescription drug benefits.

Transparency and Accountability in PBM Practices

The issue of transparency in PBM practices is a growing concern. Many stakeholders advocate for greater transparency regarding how PBMs negotiate prices and handle rebates. There is a call for clearer reporting on how much of the negotiated savings are passed on to consumers versus retained by PBMs. Efforts to improve transparency aim to provide consumers with a better understanding of their drug pricing and the factors influencing their out-of-pocket costs. Enhanced accountability could lead to more equitable pricing and improved affordability for patients.

Future Directions and Policy Changes

As the role of PBMs continues to evolve, there is ongoing debate about potential policy changes and reforms. Legislators and industry experts are exploring ways to address concerns related to drug pricing and PBM practices. Proposed reforms include measures to increase transparency, regulate rebate practices, and ensure that savings are more directly passed on to consumers. The future of PBMs and drug pricing will likely involve continued scrutiny and potential adjustments to improve the balance between cost savings, insurance premiums, and patient out-of-pocket expenses.

The Role of PBMs in Drug Pricing

Pharmacy Benefit Managers serve as the gatekeepers for prescription drug benefits. They negotiate directly with drug manufacturers to secure rebates and discounts, which can help lower the cost of medications for insurance companies. These savings are often intended to be passed on to consumers, but the extent to which this occurs can vary. PBMs also manage formularies, which are lists of covered drugs, and establish preferred drug lists that influence which medications are more affordable for patients. By negotiating lower prices and managing formularies, PBMs aim to reduce the overall cost of drugs, but their impact on drug pricing is complex and multifaceted.

One key aspect of PBM operations is their ability to leverage the buying power of large groups of insured individuals. This can lead to substantial discounts from drug manufacturers, but it also means that smaller insurers or individual patients may not benefit as much from these negotiated rates. Additionally, the PBM’s role in determining which drugs are covered and at what level can affect the availability of certain medications and the financial accessibility for patients.

How PBMs Affect Health Insurance Premiums

The influence of PBMs on health insurance premiums is significant. By negotiating lower drug prices and rebates, PBMs can help reduce the cost of prescription drugs for insurers. This, in turn, can lead to lower premiums for health insurance plans. However, the relationship between PBMs and premiums is not always straightforward. Some critics argue that the savings negotiated by PBMs do not always translate into lower premiums for consumers. Additionally, the rebates and discounts secured by PBMs may be partially offset by administrative fees and other costs, which can affect the overall cost structure of insurance plans.

Moreover, the way PBMs manage formularies and negotiate drug prices can result in variations in premium costs between different health insurance plans. Insurers with more aggressive PBM contracts might offer lower premiums, but this can sometimes come with trade-offs in terms of drug coverage or access to specific medications. The interplay between PBM-negotiated prices and insurance premiums is a key factor in determining the overall affordability of health insurance.

Impact on Out-of-Pocket Costs

PBMs also play a critical role in determining out-of-pocket costs for patients. The structure of formularies and the tier placement of drugs can significantly influence what patients pay at the pharmacy counter. Medications on higher tiers of a formulary typically come with higher co-pays or coinsurance, increasing the financial burden on patients. While PBMs strive to manage drug costs and improve affordability, the design of formularies and the extent of patient cost-sharing can lead to varying levels of out-of-pocket expenses. Understanding how PBMs impact out-of-pocket costs is essential for consumers navigating their prescription drug benefits.

The impact of formularies is particularly evident for patients requiring specialty medications, which are often placed in higher tiers with significant cost-sharing requirements. This can lead to substantial out-of-pocket expenses for individuals with chronic conditions or rare diseases. Additionally, some PBMs offer patient assistance programs to help mitigate these costs, but the availability and effectiveness of such programs can vary.

Transparency and Accountability in PBM Practices

The issue of transparency in PBM practices is a growing concern. Many stakeholders advocate for greater transparency regarding how PBMs negotiate prices and handle rebates. There is a call for clearer reporting on how much of the negotiated savings are passed on to consumers versus retained by PBMs. Efforts to improve transparency aim to provide consumers with a better understanding of their drug pricing and the factors influencing their out-of-pocket costs. Enhanced accountability could lead to more equitable pricing and improved affordability for patients.

Transparency initiatives may include requiring PBMs to disclose the financial details of their rebate agreements and how these affect drug prices and insurance premiums. Such measures could help consumers make more informed decisions about their prescription drug plans and potentially lead to more competitive pricing within the industry.

Future Directions and Policy Changes

As the role of PBMs continues to evolve, there is ongoing debate about potential policy changes and reforms. Legislators and industry experts are exploring ways to address concerns related to drug pricing and PBM practices. Proposed reforms include measures to increase transparency, regulate rebate practices, and ensure that savings are more directly passed on to consumers. The future of PBMs and drug pricing will likely involve continued scrutiny and potential adjustments to improve the balance between cost savings, insurance premiums, and patient out-of-pocket expenses.

Policy changes could also involve revisiting the regulatory framework governing PBMs to enhance their accountability and impact on drug pricing. By addressing these issues, stakeholders aim to create a more transparent and consumer-friendly system that better aligns the interests of PBMs, insurers, and patients.

Conclusion

Pharmacy Benefit Managers (PBMs) have a significant impact on drug pricing, health insurance premiums, and out-of-pocket costs. Their role as intermediaries in the drug supply chain influences the overall cost of medications and the financial burden on consumers. While PBMs aim to negotiate lower prices and manage prescription drug benefits, their practices can also lead to complexities in drug pricing and variability in patient costs. As the industry continues to evolve, addressing issues of transparency and exploring potential reforms will be crucial in shaping the future of drug pricing and its impact on health insurance.

To read complete article Click Here