Introduction: The Unfolding Crisis

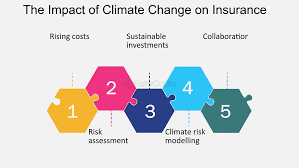

The climate change impact on insurance is becoming increasingly pronounced, with the industry facing unprecedented challenges. As extreme weather events such as hurricanes, floods, and wildfires become more frequent and severe, insurance companies are grappling with how to assess risks and set premiums. This evolving landscape is reshaping the insurance sector, compelling companies to adapt quickly to survive in a world where environmental unpredictability is the new norm.

The Financial Strain of Rising Claims

The financial burden of climate change is evident in the growing number of claims filed for climate-related damages. Insurers are witnessing a significant uptick in claims due to property damage from natural disasters, which in turn drives up the cost of coverage. The climate change impact on insurance is leading to higher premiums for policyholders, as companies seek to mitigate their increased financial risks. This trend is particularly noticeable in regions prone to natural disasters, where some insurers are even withdrawing coverage altogether to avoid unsustainable losses.

Reevaluating Risk Assessment Models

Traditional risk assessment models are proving inadequate in the face of climate change. The unpredictability of weather patterns and the increasing frequency of extreme events mean that historical data is no longer a reliable predictor of future risks. Insurance companies are now investing in advanced technologies, such as artificial intelligence and machine learning, to better predict and manage the climate change impact on insurance. These new models take into account a wider range of variables, including environmental and social factors, to provide a more accurate assessment of potential risks.

The Role of Government and Regulation

Governments and regulatory bodies are also playing a crucial role in addressing the climate change impact on insurance. In many countries, there is growing pressure on insurers to not only adjust their risk models but also to contribute to climate change mitigation efforts. This can include offering incentives for policyholders to adopt more sustainable practices, such as installing renewable energy systems or fortifying properties against extreme weather events. Additionally, some governments are stepping in to provide reinsurance or financial assistance to cover losses from catastrophic events, helping to stabilize the market.

Emerging Opportunities in the Green Insurance Market

While the challenges are significant, the climate change impact on insurance is also creating new opportunities. The growing demand for green insurance products, which offer coverage for sustainable practices and renewable energy projects, is one such opportunity. Insurers are beginning to tap into this market, developing innovative products that cater to environmentally conscious consumers and businesses. This not only helps mitigate the financial risks associated with climate change but also aligns with global efforts to reduce carbon emissions and promote sustainability.

The Financial Strain of Rising Claims

The financial burden of climate change is evident in the growing number of claims filed for climate-related damages. Insurers are witnessing a significant uptick in claims due to property damage from natural disasters, which in turn drives up the cost of coverage. The climate change impact on insurance is leading to higher premiums for policyholders, as companies seek to mitigate their increased financial risks. This trend is particularly noticeable in regions prone to natural disasters, where some insurers are even withdrawing coverage altogether to avoid unsustainable losses.

Furthermore, the financial strain is not limited to individual policyholders. Businesses, especially those in vulnerable industries like agriculture and real estate, are also facing escalating insurance costs. For companies, the increased premiums can have a ripple effect, leading to higher operational costs and even influencing business decisions such as location and expansion plans. As these costs rise, there is a growing concern that some businesses may become underinsured or choose to forgo coverage altogether, increasing their vulnerability to climate-related risks.

Reevaluating Risk Assessment Models

Traditional risk assessment models are proving inadequate in the face of climate change. The unpredictability of weather patterns and the increasing frequency of extreme events mean that historical data is no longer a reliable predictor of future risks. Insurance companies are now investing in advanced technologies, such as artificial intelligence and machine learning, to better predict and manage the climate change impact on insurance. These new models take into account a wider range of variables, including environmental and social factors, to provide a more accurate assessment of potential risks.

These advancements in technology are crucial as they allow insurers to create more precise models that can predict the likelihood of specific events, such as floods or wildfires, in particular regions. By incorporating real-time data and predictive analytics, insurers can offer more tailored policies that reflect the actual risks faced by individuals and businesses. This shift not only helps insurers better manage their financial exposure but also provides policyholders with more accurate coverage options, potentially leading to a more resilient insurance market overall.

The Role of Government and Regulation

Governments and regulatory bodies are also playing a crucial role in addressing the climate change impact on insurance. In many countries, there is growing pressure on insurers to not only adjust their risk models but also to contribute to climate change mitigation efforts. This can include offering incentives for policyholders to adopt more sustainable practices, such as installing renewable energy systems or fortifying properties against extreme weather events. Additionally, some governments are stepping in to provide reinsurance or financial assistance to cover losses from catastrophic events, helping to stabilize the market.

Moreover, regulatory bodies are increasingly requiring insurers to disclose their climate-related risks and the steps they are taking to manage them. This increased transparency is aimed at ensuring that both insurers and policyholders are fully aware of the potential impacts of climate change on their coverage. As these regulations become more stringent, insurers will need to continuously adapt their practices, not only to comply with legal requirements but also to maintain their reputations and competitiveness in the market.

Emerging Opportunities in the Green Insurance Market

While the challenges are significant, the climate change impact on insurance is also creating new opportunities. The growing demand for green insurance products, which offer coverage for sustainable practices and renewable energy projects, is one such opportunity. Insurers are beginning to tap into this market, developing innovative products that cater to environmentally conscious consumers and businesses. This not only helps mitigate the financial risks associated with climate change but also aligns with global efforts to reduce carbon emissions and promote sustainability.

Additionally, the green insurance market is paving the way for new partnerships between insurers and environmental organizations. By collaborating with these groups, insurers can develop more effective products that not only provide coverage but also actively contribute to climate change mitigation. For example, some insurers are offering policies that include incentives for reducing carbon footprints or investing in green infrastructure. These initiatives not only support global sustainability goals but also create a new revenue stream for insurers in a rapidly changing market.

Conclusion: Adapting to a New Reality

The climate change impact on insurance is a multifaceted issue that requires a comprehensive approach. As the industry adapts to the realities of a changing environment, insurers must continue to innovate, incorporating new technologies and sustainable practices into their operations. At the same time, collaboration between governments, regulators, and the private sector will be essential in ensuring that the insurance market remains stable and resilient in the face of ongoing environmental challenges. The future of insurance will undoubtedly be shaped by how well the industry can navigate the complexities of climate change.

To read complete article Click Here