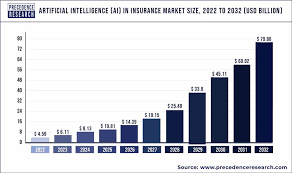

Artificial Intelligence (AI) is transforming the health insurance industry, enhancing processes like risk assessment, claims processing, and customer service. The integration of AI technologies into health insurance operations is not only streamlining these functions but also improving accuracy and efficiency. This article explores how AI is reshaping the health insurance landscape and what it means for the future of this sector.

AI in Risk Assessment

AI is revolutionizing risk assessment in health insurance by leveraging data analytics and machine learning algorithms. Traditionally, insurers relied on historical data and manual evaluations to assess risk, which could be time-consuming and prone to human error. AI enhances this process by analyzing vast amounts of data from various sources, such as medical records, lifestyle information, and genetic data. This enables insurers to create more accurate risk profiles and predict future health issues with greater precision. As a result, AI helps insurers offer more personalized policies and pricing, ultimately benefiting both the insurer and the insured.

Streamlining Claims Processing

Claims processing is another area where AI is making a significant impact. The traditional claims process often involves numerous manual steps, from verifying information to adjudicating claims. AI technologies, such as natural language processing and machine learning, can automate these tasks, significantly reducing processing times and minimizing errors. For instance, AI can automatically review and validate claim details, identify discrepancies, and flag potential fraud. This not only speeds up the claims process but also enhances the accuracy of claim settlements, leading to greater customer satisfaction.

Enhancing Customer Service

Customer service in health insurance is also being transformed by AI. Insurers are increasingly using AI-powered chatbots and virtual assistants to provide instant support and handle routine inquiries. These AI tools can assist customers with policy information, claims status, and general queries 24/7, improving accessibility and response times. Additionally, AI-driven analytics can help insurers better understand customer needs and preferences, allowing for more tailored and proactive service. By automating routine tasks and providing valuable insights, AI enables human agents to focus on more complex and personalized customer interactions.

Challenges and Considerations

Despite the benefits, the integration of AI in health insurance comes with its challenges. One major concern is data privacy and security, as AI systems rely on sensitive personal health information. Insurers must ensure that they comply with regulations and implement robust security measures to protect this data. Additionally, there is the risk of algorithmic bias, where AI systems may unintentionally perpetuate existing biases in the data. Addressing these challenges requires ongoing vigilance and ethical considerations to ensure that AI is used responsibly and fairly.

The Future of AI in Health Insurance

Looking ahead, AI is expected to play an even more significant role in health insurance. Advances in AI technology, such as more sophisticated machine learning algorithms and enhanced data integration capabilities, will likely lead to even more accurate risk assessments and streamlined processes. Furthermore, AI could enable the development of innovative insurance products and services that cater to emerging health trends and consumer needs. As the technology continues to evolve, insurers will need to stay abreast of these developments to fully leverage AI’s potential and maintain a competitive edge.

AI in Risk Assessment

AI is revolutionizing risk assessment in health insurance by leveraging data analytics and machine learning algorithms. Traditionally, insurers relied on historical data and manual evaluations to assess risk, which could be time-consuming and prone to human error. AI enhances this process by analyzing vast amounts of data from various sources, such as medical records, lifestyle information, and genetic data. This enables insurers to create more accurate risk profiles and predict future health issues with greater precision. As a result, AI helps insurers offer more personalized policies and pricing, ultimately benefiting both the insurer and the insured. For example, AI-driven predictive models can identify high-risk individuals early, allowing for proactive interventions that can potentially lower overall health costs.

Streamlining Claims Processing

Claims processing is another area where AI is making a significant impact. The traditional claims process often involves numerous manual steps, from verifying information to adjudicating claims. AI technologies, such as natural language

This exploration of AI’s impact on health insurance highlights the significant advancements being made and the potential for further innovation. As AI continues to evolve, its integration into health insurance promises to enhance efficiency, accuracy, and customer satisfaction, marking a new era in the industry.

To read complete article Click Here