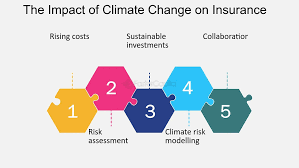

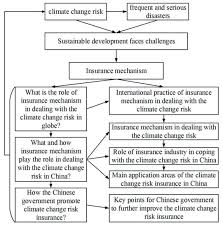

Climate change is profoundly altering the landscape of material insurance policies and risk assessment practices. As global temperatures rise and weather patterns become more erratic, the traditional methods used to evaluate risk and set insurance premiums are becoming increasingly inadequate. The focus keyword for this article, climate change and material insurance, reflects the growing need for insurers to adapt their strategies in response to evolving environmental conditions. This article explores how climate change is reshaping material insurance and the ways insurers are adjusting their approaches to risk assessment.

Shifting Risk Assessment Models

Historically, risk assessment in material insurance relied heavily on historical data and relatively static risk factors. Insurers used past weather patterns and damage reports to predict future risks and determine coverage needs. However, the accelerating pace of climate change is introducing new variables that traditional models struggle to accommodate. Extreme weather events, such as hurricanes, floods, and wildfires, are occurring with increasing frequency and intensity. As a result, insurers are revising their risk assessment models to incorporate climate projections and more sophisticated data analytics. This shift aims to provide a more accurate picture of potential risks and help set more precise premiums.

Increased Frequency of Extreme Weather Events

One of the most significant impacts of climate change on material insurance is the increased frequency of extreme weather events. Rising global temperatures are contributing to more intense storms, heavier rainfall, and prolonged droughts, all of which can cause substantial damage to properties. Insurers must now consider these heightened risks when crafting their policies. The traditional approach of assessing risk based on historical weather data is no longer sufficient, as the frequency and severity of extreme events are surpassing past norms. This has led to higher premiums and more comprehensive coverage requirements. Insurance policies are being adapted to cover new types of damage and to reflect the changing nature of climate-related risks.

Adjusting Policy Coverage and Pricing

As the impact of climate change becomes more pronounced, insurers are also revising their policy coverage and pricing structures. Policies are being updated to address new and emerging risks associated with climate change. This may include expanding coverage for specific climate-related hazards, such as flood or wildfire insurance, and introducing specialized policies for areas deemed high-risk. Pricing strategies are being adjusted to reflect the increased likelihood of claims due to more frequent and severe weather events. Premiums are rising, and deductibles may be higher for properties located in high-risk areas. Insurers are balancing the need to provide adequate coverage with the financial implications of increased risk.

Emphasizing Preventive Measures

In response to the growing risks posed by climate change, there is a stronger emphasis on preventive measures within material insurance policies. Insurers are recognizing the value of risk mitigation strategies and are encouraging policyholders to invest in resilience measures. This may include reinforcing buildings, using climate-resistant materials, and implementing flood defenses. By promoting preventive actions, insurers aim to reduce the overall risk of damage and, potentially, lower premiums for those who take proactive steps to protect their properties. This shift towards prevention not only benefits policyholders but also helps insurers manage their risk exposure more effectively.

Collaborating with Climate Experts

To navigate the complexities of climate change and its impact on insurance, many insurers are partnering with climate experts and researchers. These collaborations provide valuable insights into future climate scenarios and help refine risk assessment models. Climate experts offer data-driven forecasts and analysis, enabling insurers to adjust their policies and practices based on the latest scientific understanding of climate trends. This partnership ensures that insurance solutions are grounded in accurate, up-to-date information, enhancing the effectiveness of risk management strategies.

Conclusion: Adapting to a Changing Climate

The influence of climate change on material insurance policies and risk assessment is profound and multifaceted. Insurers are adapting to these changes by revising risk models, adjusting coverage and pricing, emphasizing preventive measures, and collaborating with climate experts. As climate patterns continue to evolve, the insurance industry must remain agile and proactive in addressing new risks and challenges. By staying informed and responsive, insurers can better manage the impacts of climate change and provide more robust and effective coverage for their policyholders. The ongoing evolution of material insurance in response to climate change underscores the importance of adapting to a rapidly changing environment and preparing for future uncertainties.

To read more articles like this click here.

To read more about such topics click here.