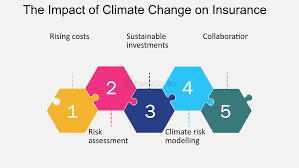

Climate change is profoundly reshaping various industries, and the insurance sector is no exception. One critical area of impact is material insurance, where the evolving climate conditions are influencing risk assessments and policy frameworks. The focus keyword for this article is “climate change material insurance,” which underscores the growing need to address the relationship between shifting environmental conditions and insurance coverage for physical assets.

As global temperatures rise and weather patterns become more erratic, material insurance providers are increasingly challenged to adapt their policies. This adaptation involves re-evaluating risks associated with natural disasters, such as floods, hurricanes, and wildfires, which are becoming more frequent and severe due to climate change. Insurers must incorporate these changing dynamics into their risk models to offer accurate and fair coverage. The growing impact of these climate-induced risks necessitates a thorough examination of how material insurance policies are evolving in response.

The Growing Risks: How Climate Change Affects Material Insurance

Climate change is amplifying risks for insured materials, with extreme weather events becoming more common. These events lead to increased damage to properties, machinery, and infrastructure, which insurers must account for in their policies. For instance, the rising frequency of intense storms can cause significant damage to buildings and equipment, prompting insurers to reassess risk levels and coverage limits.

Additionally, the increased intensity of natural disasters, such as hurricanes and wildfires, exacerbates the challenges faced by insurers. These events can lead to substantial financial losses, requiring insurers to adjust their models and pricing strategies. The need for comprehensive coverage that addresses these emerging risks has never been greater. Insurers are now tasked with finding ways to balance adequate protection for policyholders while managing their own exposure to climate-related losses.

Policy Adjustments: Adapting to New Realities

In response to the shifting risk landscape, material insurance policies are evolving. Insurers are adjusting their coverage options to address the specific impacts of climate change. For example, policies are increasingly including clauses related to climate-related damages, such as those caused by flooding or wildfires. This ensures that policyholders are protected against the growing array of climate-induced risks.

Moreover, insurers are developing new types of coverage to meet emerging needs. These include policies that cover damages from climate events not previously considered significant or that provide support for rebuilding efforts in climate-affected areas. By offering more tailored solutions, insurers can better address the unique challenges posed by climate change. This proactive approach helps to ensure that policies remain relevant and effective in a rapidly changing environment.

Mitigation Strategies: How Insurers Are Managing Climate Risks

To manage the heightened risks associated with climate change, insurers are adopting various mitigation strategies. These strategies include improving risk assessment tools and incorporating climate data into underwriting processes. By leveraging advanced modeling techniques and climate forecasts, insurers can better predict and prepare for potential risks.

Furthermore, insurers are encouraging policyholders to implement preventive measures. For instance, they may offer incentives for property upgrades that enhance resilience to climate impacts, such as flood barriers or wildfire-resistant materials. These proactive measures not only reduce potential damages but also help stabilize insurance costs by mitigating risks. Insurers are also collaborating with local governments and organizations to promote community-level resilience initiatives, further reducing the overall risk exposure.

The Future Outlook: Navigating an Uncertain Climate

Looking ahead, the influence of climate change on material insurance will continue to evolve. Insurers must remain vigilant and adaptable as new climate trends emerge and impact material risks. This requires ongoing research and innovation to develop policies that effectively address future challenges.

In the coming years, we can expect further advancements in climate modeling and risk assessment, which will enable insurers to offer more precise and relevant coverage. Additionally, collaboration between insurers, policymakers, and the scientific community will be crucial in developing strategies that mitigate climate-related risks and ensure the sustainability of material insurance. The role of technology and data analytics will be increasingly important in enhancing our ability to understand and respond to the complex interplay between climate change and insurance risks.

Conclusion: Embracing Change and Innovation

The influence of climate change on material insurance is a growing concern that necessitates a proactive approach from insurers. By understanding and addressing the changing risks associated with climate impacts, insurers can better protect their policyholders and ensure that coverage remains robust and effective. As the climate continues to evolve, so too must insurance policies, embracing innovation and adaptability to navigate the uncertainties of the future.

The ongoing adaptation of material insurance policies to climate change is not just a response to immediate risks but also a strategic approach to future-proofing against long-term uncertainties. Insurers that successfully integrate climate considerations into their risk management and policy design will be better positioned to provide comprehensive coverage and support in an increasingly volatile environment.

To read more articles like this click here.

To read more about such topics click here.