The rise of pet wellness plans has transformed the way pet owners approach their animals’ health and well-being. Unlike traditional pet insurance, which typically covers unexpected illnesses and accidents, pet wellness plans emphasize preventive care by covering routine services such as vaccinations, dental cleanings, and regular check-ups. This shift underscores a growing recognition among pet owners that regular, preventive care is essential to ensuring their pets lead long, healthy lives.

As the rise of pet wellness plans continues, more pet owners are adopting these plans as a proactive approach to managing their pets’ health. The focus on preventive care helps to avoid serious health issues down the line, offering a different, more consistent approach than the traditional reactive care provided by pet insurance.

Understanding Pet Wellness Plans

The rise of pet wellness plans is driven by the increasing demand for preventive care packages that cover routine services aimed at maintaining a pet’s overall health. These plans typically include coverage for vaccinations, flea and tick prevention, heartworm testing, routine blood work, and dental cleanings. Some plans may also offer discounts on additional services such as spaying or neutering, microchipping, and even nutritional counseling.

Unlike traditional pet insurance, which involves paying a monthly premium and meeting deductibles before coverage kicks in, pet wellness plans often operate on a subscription model. Pet owners pay a monthly or annual fee that covers the costs of routine care throughout the year. This structure allows pet owners to budget for their pet’s care more easily and ensures that essential health services are not skipped due to financial constraints.

Key Differences Between Pet Wellness Plans and Traditional Pet Insurance

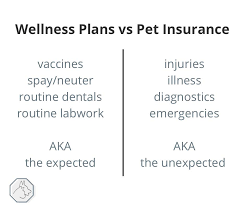

While both pet wellness plans and traditional pet insurance aim to support pet health, they serve different purposes and operate in distinct ways. Traditional pet insurance is designed to cover the costs of unexpected events such as accidents, injuries, and illnesses. This type of insurance is particularly valuable when dealing with costly treatments like surgeries or cancer therapies, which can quickly add up to thousands of dollars.

In contrast, pet wellness plans focus on routine, preventive care rather than covering emergencies. They provide coverage for the everyday care that pets need to stay healthy, such as vaccinations, regular veterinary visits, and screenings. As a result, wellness plans help pet owners avoid the high costs of treating preventable diseases by encouraging regular check-ups and early intervention.

The Benefits of Pet Wellness Plans

One of the main benefits of pet wellness plans is the emphasis on preventive care. Regular check-ups, vaccinations, and routine screenings can help detect potential health issues before they become serious, ultimately saving pet owners money on more expensive treatments down the line. Moreover, these plans often come with added perks such as discounts on specific services, making it more affordable for pet owners to provide comprehensive care for their pets.

Another advantage is the predictability of costs. With a pet wellness plan, pet owners know exactly what they will be paying each month or year, which can make budgeting for pet care much easier. This is particularly beneficial for those with multiple pets or those who want to ensure that their pets receive consistent care without worrying about unexpected expenses.

Limitations of Pet Wellness Plans

While pet wellness plans offer numerous benefits, they are not without limitations. One of the primary drawbacks is that they do not cover emergencies or unexpected health issues, which are often the most financially burdensome aspects of pet care. Pet owners who rely solely on wellness plans may find themselves unprepared for significant veterinary bills if their pet becomes seriously ill or injured.

Additionally, pet wellness plans are not standardized, meaning that coverage can vary significantly between providers. Pet owners need to carefully review what is included in a plan to ensure it meets their pet’s specific needs. Some plans may have restrictions on the types of services covered or may only be available for certain types of pets, such as dogs or cats.

Combining Pet Wellness Plans with Traditional Pet Insurance

For comprehensive coverage, many pet owners choose to combine pet wellness plans with traditional pet insurance. This approach allows them to take advantage of the preventive care benefits offered by wellness plans while also being protected against the high costs of unexpected accidents or illnesses. By using both types of coverage, pet owners can ensure that their pets receive the best possible care throughout their lives.

When considering whether to combine a pet wellness plan with traditional insurance, pet owners should evaluate their pet’s age, breed, and overall health. Younger pets might benefit more from a wellness plan, as they require frequent vaccinations and check-ups, while older pets might need the more extensive coverage provided by traditional insurance to manage chronic conditions or serious illnesses.

Conclusion

The rise of pet wellness plans reflects a growing emphasis on preventive care in the pet industry, offering pet owners a proactive way to manage their pets’ health. By covering routine services such as vaccinations and check-ups, wellness plans help prevent health issues before they become serious and expensive. However, they differ significantly from traditional pet insurance, which is designed to cover unexpected accidents and illnesses. For pet owners seeking the best care for their pets, combining both types of coverage can provide comprehensive protection and peace of mind.

To read more articles like this click here.

To read more about such topics click here.