Introduction

The insurance industry, long known for its traditional approach, is undergoing a significant transformation thanks to advancements in technology. Central to this change is the integration of AI and machine learning in insurance processes. These technologies are not only enhancing operational efficiency but are also revolutionizing how insurers assess risk, underwrite policies, and interact with customers. The growing impact of AI and machine learning in insurance is undeniable, as companies increasingly recognize the benefits of these cutting-edge tools.

Enhanced Risk Assessment and Underwriting AI and machine learning in insurance

Traditionally, underwriting involved a lengthy process of evaluating a client’s risk based on historical data and personal judgment. However, AI and machine learning algorithms can now analyze vast amounts of data in real time, providing more accurate risk assessments. By considering numerous variables, including social media activity, purchasing behavior, and even geolocation data, AI-driven models offer a more comprehensive risk profile, leading to more precise policy pricing.

Improved Fraud Detection and Prevention

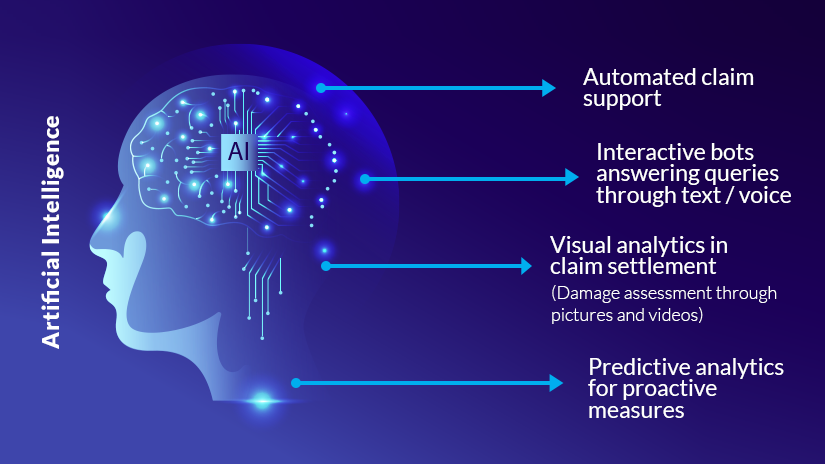

Fraud is a major concern for insurers, costing billions annually. AI and machine learning in insurance are playing a pivotal role in combating this issue. Machine learning algorithms can identify patterns and anomalies that might indicate fraudulent activity, often before a human investigator would notice. By continuously learning from new data, these systems improve over time, becoming increasingly adept at detecting fraud. This proactive approach not only saves money but also ensures that legitimate claims are processed more swiftly.

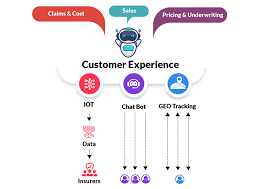

Personalized Customer Experiences

Today’s consumers expect personalized services, and the insurance sector is no exception. AI and machine learning enable insurers to offer tailored products and services to their clients. By analyzing data such as customer preferences, behavior, and feedback, AI-driven systems can suggest policies that are more relevant to individual needs. This level of personalization not only improves customer satisfaction but also fosters loyalty, as clients feel that their insurer truly understands their needs.

Streamlining Claims Processing

The claims process is often seen as a pain point for insurance customers. Delays, complex paperwork, and a lack of transparency can lead to frustration. However, the adoption of AI and machine learning in insurance is streamlining this process. Automated systems can handle claims faster and more accurately than traditional methods. For example, AI-powered chatbots can guide customers through the initial stages of filing a claim, while machine learning algorithms assess the validity of the claim and determine the payout amount. This results in a faster, more efficient claims process, reducing the time it takes for customers to receive their payments.

Regulatory Compliance and Risk Management

Insurance companies operate in a heavily regulated environment, with strict compliance requirements. AI and machine learning in insurance help companies navigate these regulations by automating compliance checks and ensuring that all processes adhere to legal standards. Additionally, these technologies assist in managing risk by predicting potential regulatory changes and their impact on the business. By staying ahead of compliance issues, insurers can avoid costly fines and maintain their reputation in the market.

Challenges and Considerations

While the benefits of AI and machine learning in insurance are clear, there are also challenges to consider. Data privacy and security are paramount, as these technologies rely on vast amounts of personal data. Insurers must ensure that they are collecting, storing, and using data in a way that complies with privacy laws and protects customer information. Additionally, there is the issue of transparency in AI-driven decisions. Customers and regulators alike may demand explanations for how certain conclusions, such as risk assessments or claim denials, are reached. Insurers must balance the efficiency of AI with the need for transparency and accountability.

Conclusion

The integration of AI and machine learning in insurance is driving significant change in the industry, from improved risk assessment and fraud detection to personalized customer experiences and streamlined claims processing. However, as with any technological advancement, it is crucial for insurers to address the associated challenges, particularly in terms of data privacy and transparency. As AI and machine learning continue to evolve, their role in the insurance industry will only grow, offering new opportunities for innovation and efficiency.

To read complete article Click Here.